When you buy a stock in the Indian market, you usually look at its market price, like ₹150 or ₹600. But every share also has a hidden number called the face value of the share. This is the original price written on the share by the company when it was first issued. It doesn’t change with the market price and is often ₹1, ₹2, or ₹10 in India.

You may think it’s not important, but face value plays a big role in things like dividends, IPO pricing, and bonus shares. In this blog, we’ll break down what face value means in the share market, how it is calculated, and why it matters for every Indian investor, especially beginners like you.

In the Indian share market, every stock has two values—market price and face value. The face value in the share market refers to the fixed base price of a share, decided by the company during its launch. It doesn’t change daily like market price and is used for accounting and legal records.

This value helps determine a company’s share capital and plays an important role in things like dividend calculation, IPO pricing, stock splits, and more. For example, many Indian companies set face value at ₹1, ₹2, or ₹10 when they issue shares. While the trading price can move up or down, the face value stays constant unless there’s a corporate action like a stock split or consolidation.

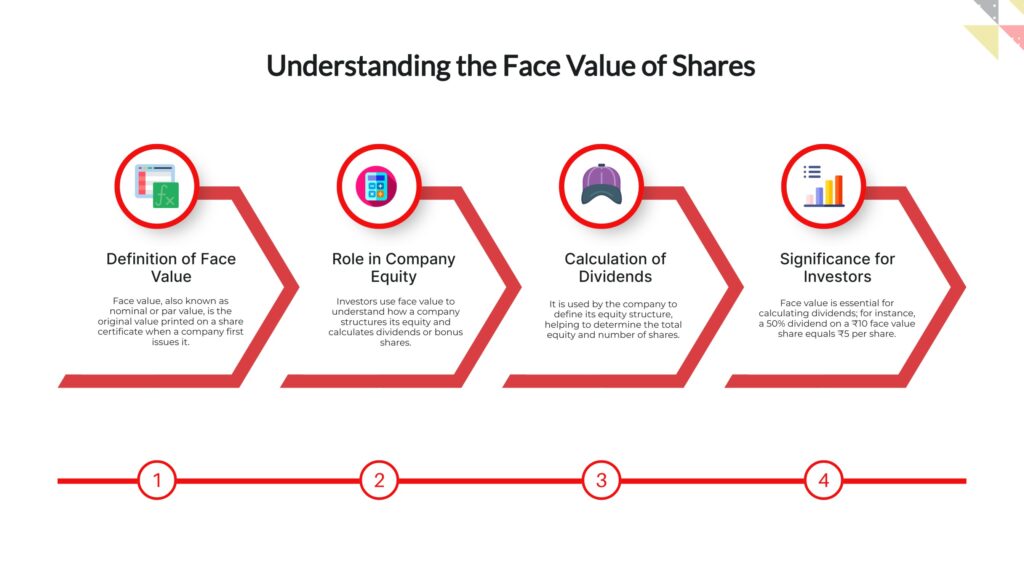

The face value of shares is the original value printed on a share certificate when it is first created by the company. It’s also called nominal value or par value. This is not the price at which you buy or sell the share in the market—it is the value used by the company to define its equity structure.

For example, if a company has ₹10 lakh in share capital and issues 1 lakh shares, each share will have a face value of ₹10. This value helps in calculating dividends (e.g., 50% dividend on ₹10 face value = ₹5 per share), understanding how much equity the company has, and how many shares exist in total.

Face value is important for investors who want to know how a company structures its equity and how dividends or bonus shares are calculated based on it.

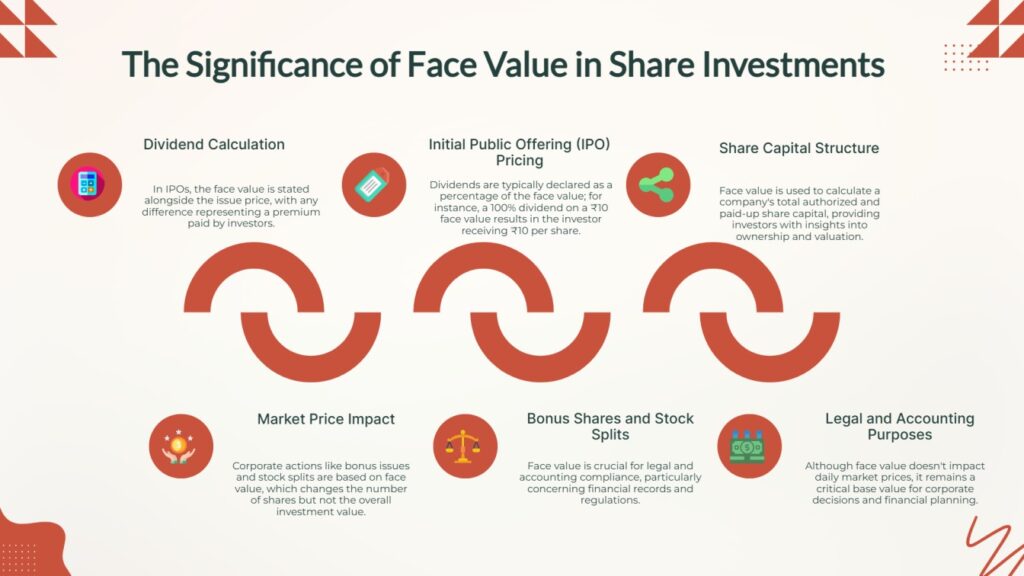

The face value of share may look small or fixed, but it plays a very important role in how a company manages its equity and how investors understand their returns. Here’s why it matters:

The face value of share is not guessed or decided randomly — it’s calculated based on the company’s financial structure. The formula is very simple:

Face Value = Equity Share Capital ÷ Total Number of Outstanding SharesLet’s say a company has an equity share capital of ₹50,00,000 and it has issued 5,00,000 shares in total. Using the formula:

Face Value = ₹50,00,000 ÷ 5,00,000 = ₹10 per shareSo, the nominal value or face value of each share is ₹10, even if the market price of that share is ₹400 or ₹500.

In India, many listed companies originally issue shares with a face value of ₹1, ₹2, ₹5, or ₹10 depending on their financial structure and regulatory filings. This value becomes the base for things like dividend declarations or corporate announcements like stock splits.

Corporate actions are special decisions taken by a company that directly affect its shares and shareholders. Some of these actions can change the face value of a share, while others use face value as the base for calculation.

Here are some important corporate actions and their relation to face value:

Face value is the fixed price set by the company, market value keeps changing based on supply and demand in the stock market.

| Feature | Face Value of Share | Market Value of Share |

|---|---|---|

| Meaning | Fixed value set by company at issue time | Current trading price in the stock market |

| Also Known As | Nominal value / Par value | Trading price / Current share price |

| Who Decides It | The company | Stock market (buyers and sellers) |

| Can It Change? | Only after corporate actions like stock split | Changes daily with market movement |

| Common Values in India | ₹1, ₹2, ₹5, ₹10 | Can be ₹50, ₹500, ₹5000, etc. |

| Used For | Dividends, bonus shares, accounting | Buying, selling, stock valuation |

| Seen In | Share certificates, IPO details | Stock trading apps, market watchlists |

In India, most listed companies issue shares with a face value of ₹1, ₹2, ₹5, or ₹10. Among these, ₹10 has traditionally been the most common, especially for older companies. However, in recent years, many companies have started issuing shares with a face value of ₹1 to improve affordability and flexibility in corporate actions like stock splits and bonuses.

Public sector companies like SBI, NTPC, and ONGC typically have shares with a face value of ₹10. On the other hand, many newer private sector companies, including those in technology and finance, have opted for ₹1 or ₹2 face value to keep the share price retail-friendly and improve liquidity in the market.

It's also observed that face value does not affect the market price directly, but changes in face value due to a stock split or reverse split often lead to temporary shifts in trading volume. Moreover, SEBI mandates that every IPO clearly mention the face value, ensuring transparency for retail investors.

While the face value of a share doesn't directly impact returns or market price, it can influence how investors—especially beginners—perceive a stock. Shares with a lower face value (like ₹1 or ₹2) often give companies more flexibility to issue bonus shares or conduct stock splits, making the stock seem more attractive or affordable to small investors.

Sometimes, retail investors assume that a low face value means the stock is undervalued or cheap, which is not always true. This psychological effect can lead to misjudged investment decisions if one doesn’t focus on actual fundamentals like earnings, P/E ratio, or book value.

Face value also plays a role in screening stocks during IPOs or when reviewing a company’s financial structure. For informed investors, checking face value helps compare the capital base across companies, especially in sectors like banking or FMCG where share structures may differ widely.

The face value of a share changes only during specific corporate actions like a stock split or a reverse stock split. In a stock split, the face value reduces as shares are divided into smaller parts. In a reverse split, it increases by combining multiple shares into one. This change helps companies adjust share price and improve liquidity.

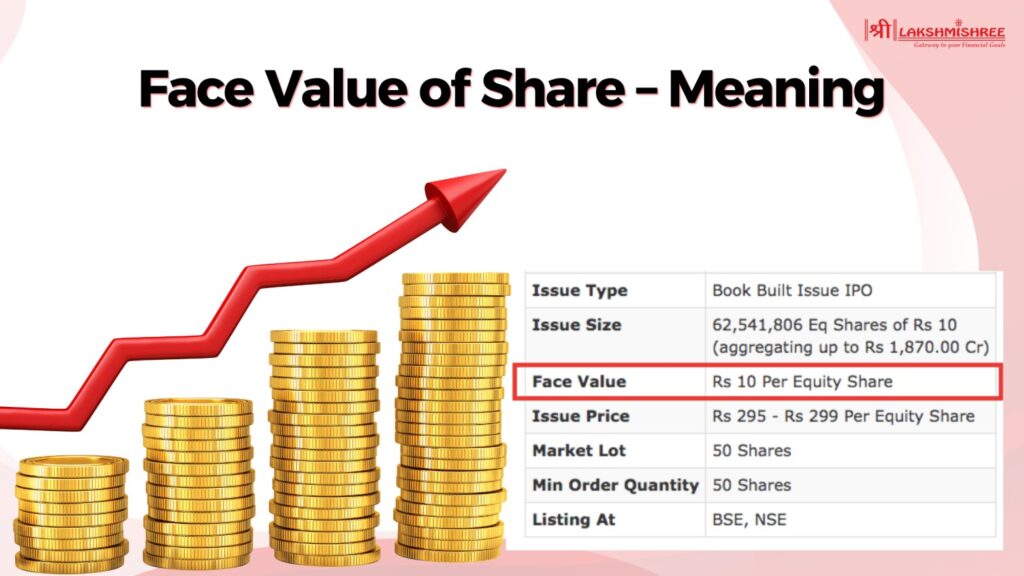

In an IPO, the face value of a share is the original price set by the company, usually ₹1, ₹2, or ₹10. It is different from the issue price, which includes a premium added over the face value. SEBI rules require companies to clearly mention the face value in every IPO offer document.

The face value of share is the fixed original price decided by a company, commonly ₹1, ₹2, or ₹10 in India. While it doesn’t affect the trading price, it plays a key role in dividend calculation, IPO pricing, and corporate actions like stock splits. Knowing the face value helps investors understand the company’s capital structure. It also brings clarity when comparing shares across different companies. For beginners in the Indian stock market, learning about face value is a smart step toward making informed investment decisions.

The face value of a share is the original price set by a company when it issues the share. For example, if a company issues 1 lakh shares with a total share capital of ₹10 lakh, the face value of each share is ₹10. This value is printed on the share certificate and used for calculating dividends and other corporate actions.

Yes, the face value of a share can change, but only during specific corporate actions like a stock split or reverse stock split. In a stock split, the face value is reduced and the number of shares increases. In a reverse split, multiple shares are merged into one, increasing the face value while reducing the number of shares.

Face value is the fixed base value of a share decided by the company, while market value is the current trading price on the stock exchange. Market value changes daily based on demand and supply, but face value remains constant unless altered by a corporate action.

In an IPO, the company must mention the face value of the share along with the issue price. The face value helps investors understand how much premium the company is charging over the base price. For example, an IPO priced at ₹250 with a face value of ₹10 means ₹240 is the premium.

Yes, face value is important as it is used for calculating dividends, understanding bonus shares, and tracking changes during stock splits. While it may not directly impact your profits, knowing the face value helps in understanding the financial structure and announcements made by the company.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The securities referenced are provided as examples and should not be considered as recommendations.